UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under Rule 14a-12

RGC RESOURCES, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

_________________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

RGC RESOURCES, INC.

519 Kimball Avenue, N.E.

Roanoke, Virginia 24016

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD FEBRUARY 1, 20164, 2019

December 14, 2018

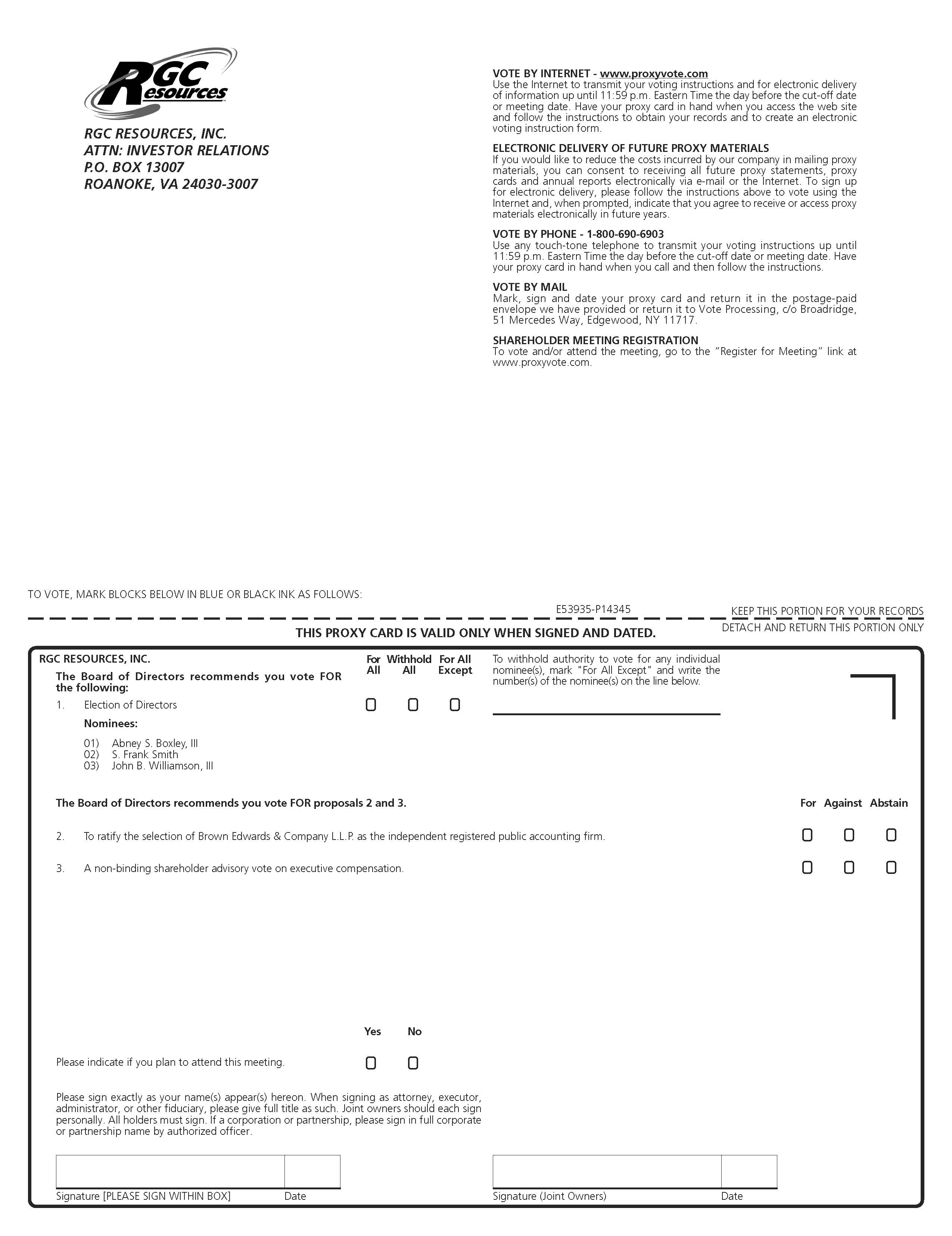

NOTICE is hereby given that, pursuant to its Bylaws and call of its Directors, the Annual Meeting of the Shareholders of RGC Resources, Inc. will be held at The Hotel Roanoke and Conference Center, 110 Shenandoah Avenue, Roanoke, Virginia 24016, on Monday, February 1, 2016,4, 2019, at 9:00 a.m., for the purposes of:

1. Electing three Class A directors.

| 2. | Ratifying the selection of Brown, Edwards & Company, L.L.P. as the independent registered public accounting firm. |

| 3. | Approving, on an advisory basis, the compensation of our named executive officers. |

| 4. | Acting on such other business as may properly come before the Annual Meeting. |

Your attention is directed to the Proxy Statement accompanying this Notice for a more complete statementdescription regarding matters proposed to be acted upon at the meeting. Only those shareholders of record as of the close of business on November 25, 201523, 2018 shall be entitled to vote at the meeting.

vote. If you plan to attend the Annual Meeting, please so indicate in the space provided on the proxy card or respond when prompted on the telephone or through the Internet. Admission to the meeting please contact Sherry Shaw at (540) 777-3972 or by emailing Ms. Shaw at Sherry_Shaw@RoanokeGas.com.will be limited to invited guests and those who respond and bring their admission card and proper ID with them.

PLEASE VOTE YOUR SHARES BY THE INTERNET, BY TELEPHONE OR BY PROMPTLY MARKING, DATING, SIGNING AND RETURNING THE ENCLOSED PROXY CARD.

Sincerely,

John B. Williamson, III

Chairman

Important Notice Regarding the Availability of Proxy Materials. This Notice for the Annual Meeting please make sure to vote. You may vote by one of Shareholders, the following methods: (1) on-lineattached Proxy Statement and our 2018 Annual Report on Form 10-K are available at www.proxyvote.com (2) completing, signing and returning the enclosed proxy in the postage paid envelope provided (3) telephonically by calling (800) 690-6903 or (4) in person, even if you have previously sent in your proxy or voted on-line. Please note that the method by which you vote last will be the vote the Company counts. If your shares are held by a broker, bank or nominee, it is important that you provide them your voting instructions.www.rgcresources.com/corporate-governance/.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD FEBRUARY 1, 2016 4, 2019

This Proxy Statement is furnished in connection with the solicitation of proxies to be used at the Annual Meeting of Shareholders of RGC Resources, Inc. ("we", “Resources”"our", "Resources" or the "Company") to be held on Monday, February 1, 2016,4, 2019, at 9:00 a.m. at The Hotel Roanoke and Conference Center, 110 Shenandoah Avenue, Roanoke, Virginia 24016 (the “Annual Meeting”).

Record Date and Voting Securities

Notice of the Company's Annual Meeting was mailed on or about December 16, 201514, 2018 to all shareholders of record. Only shareholders of record at the close of business on November 25, 2015,23, 2018, the record date, are entitled to vote at the Annual Meeting. A list of shareholders entitled to vote at the Annual Meeting will be open to the examination ofby any shareholder, for any purpose germane to the meeting, during ordinary business hours at the Company’s offices at 519 Kimball Avenue, N.E., Roanoke, Virginia 24016, and at the time and place of the meeting.

As of the record date, 4,750,645 common 8,003,606 common shares were issued and outstanding. Each common share is entitled to one vote. A majority of the common shares outstanding entitled to vote on the record date, or at least 2,375,323 common shares, whether present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting. Less than a quorum may adjourn the meeting.

Proxies in the form enclosed herewith are solicited by management at the direction of the Company’s Board of Directors.Directors (the "Board").

Voting Procedures

Shareholders of record may vote in person at the Annual Meeting, on-line at www.proxyvote.com, by mailing the proxy card or by telephone by calling (800) 690-6903. Votes cast at the Annual Meeting will be tabulated by an Inspector of Elections, appointed by the Company. All proxy materials are available on the Company's website at www.rgcresources.com.

If you plan to attend the Annual Meeting, please so indicate when you return your proxy card, so that we may send you an admission ticket and make the necessary arrangements. Shareholders who plan to attend the Annual Meeting must present valid, government-issued photo identification along with an admission ticket.

If your shares are held in a stock brokerage account or by a bank, broker, trustee, or other nominee, you are considered the beneficial owner"beneficial owner" of shares held in "street name." You should have received a voting instruction form with these proxy materials from that organization rather than from the Company. As a beneficial owner, you still have the right to direct your broker or other nominee regarding how to vote the shares in your account by following these voting instructions. If you are a beneficial owner and do not instruct your broker or nominee how to vote your shares, this is considered a "broker non-vote" except thatthe brokers and nominees can use their discretion to vote “uninstructed” shares with respect to Proposal No. 2 regarding the ratification of our independent registered public accounting firm.firm, which is considered a "broker non-vote" for other matters.

Abstentions and broker non-votes are counted as shares present and entitled to vote for the purpose of determining a quorum. Abstentions will be counted towards the vote total for each of Proposals No.Proposal Nos. 2 and 3 and will have the same effect as “Against”AGAINST votes.

If you return a signed and dated proxy card without marking voting selections or providing different instructions on the proxy card, your shares will be voted at the meeting FOR the election of the three director nominees listed in Proposal No. 1, FOR the ratification of the appointment of our independent registered public accounting firm in Proposal No. 2 and FOR the advisory approval of executive compensation in Proposal No. 3. With respect to any other business that may properly come before the Annual Meeting and be submitted to a vote of shareholders, proxies will be voted in accordance with the best judgment of the designated proxy holders. We do not know of any matters to be presented at the Annual Meeting other than those described in this proxy statement.

The director nominees listed in Proposal No. 1 will be elected by a plurality of the votes of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. The three nominees receiving the most “For”FOR votes will be elected.

1

The appointment of our independent registered public accounting firm listed in Proposal No. 2 will be ratified if a majority of shares present or represented by proxy at the Annual Meeting and entitled to vote thereon vote “For”FOR such proposal.

Proposal No. 3, advisory approval of the compensation of the Company’s named executive officers, will be considered to be approved if it receives “For”FOR votes from the holders of a majority of shares either present or represented by proxy and entitled to vote.

Revoking a Proxy

Remainder of page intentionally left blank

2

PROPOSAL 1: ELECTION OF DIRECTORS OF RESOURCES

The Company’s Board of Directors consists of nine members and is divided into three classes (A, B, and C) with staggered three-year terms. The current term of office of the Class A directors expires at the 2019 Annual Meeting. The terms of Class B and C directors expire in 20172020 and 2018,2021, respectively. Each of the Company’s current directors and nominees for election are independent directors, as determined under the Company’s independence standards adopted in accordance with the applicable rules of the Securities and Exchange Commission (the “SEC”) and the NASDAQ, Stock Market, except John S. D’Orazio and John B. Williamson, III.D’Orazio.

There are three nominees for Class A directors: Abney S. Boxley, III, S. Frank Smith and John B. Williamson, III. The Governance and Nominating Committee and the Board of Directors have selected and endorsed each of these candidates because each brings unique talents and business experience to the Board.

Abney S. Boxley, III is President - East Region, Summit Materials, an SEC registered manufacturer and distributor of construction materials and aggregate. Mr. Boxley was most recently President and CEO of Boxley Materials Company, a manufacturer and distributor of construction materials and aggregate, a position in which he has served for 27 years.from 1998 to October 2018. He also serves on the board of directors of BNC Bancorp, a publicly heldPinnacle Financial Partners, Inc., an SEC registered public bank holding company, Insteel Industries, Inc., an SEC registered manufacturer of steel wire reinforcing products, and Carilion Clinic, a local health-care organization. Mr. Boxley has been a director of the Company since 1994. He holds an MBA degree from the University of Virginia Darden School and serves on the boards of numerous community organizations in the Company's service area.School.

We believe that Mr. Boxley's financialdeep understanding of mergers and acquisitions, business background, as well asdevelopment and his knowledge of local construction and economic development opportunities in the Company's service area make him a valuable member of our Board.

S. Frank Smith is a consultant toretired from Alpha Coal Sales Company, LLC, a division of the largest coal producer in the mid-Atlantic area. Mr. Smithand previously served as Consultant and Vice President - Industrial Sales with Alpha Coal Sales Company, LLC. He has beenMr. Smith was in the coal marketing and product acquisition business for over 40 years. Mr. Smith has been a director of the Company since 1990 and holds a Masters of Arts degree from Hollins University.

We believe Mr. Smith's in-depth knowledge of the competitive and regulatory landscape of energy markets is helpful to our understanding of the rapidly changing energy industry and its implications on our customer base. This, in addition to his leadership as chair of the Compensation Committee, makemakes him a valuable member of our Board.

John B. Williamson, III currently serves as Chairman of the Board. Mr. Williamson formerly served as the Company's President and Chief Executive Officer and was involved in the executive management of the Company beginning in 1992.1992 and has served on the Board since 1998. Mr. Williamson holds an MBA from the College of William and Mary. Mr. Williamson is a member of the boardsboard of directors of the Bank of Botetourt, Inc., a local bank, where he serves as chairman of its nominating and corporate governance committee, Optical Cable Corporation, a publicly heldan SEC registered optical fiber cable manufacturer, where he serves as the chairman of the audit committee and a member of the nominating and corporate governance committee, Luna Innovations Incorporated, a publicly heldan SEC registered technology company, where he serves as chairman of the audit committee and a member of the of the nominating and governance committee, and Corning Natural Gas Holding Corporation, a publicly heldan SEC registered natural gas distribution company located in the state of New York, where he serves as chairmanand the Bank of the audit committee andBotetourt, a member of the compensation committee.non-registered publicly traded bank.

We believe that Mr. Williamson's utility industry experience, understanding of the changing natural gas business and in-depth knowledge of the operational, financial and regulatory aspects of the Company provide the management team valuable strategic and operating expertise, and, along with his public company board experiencesexperience in corporate governance, strategic planning and compliance, make him a valuable member of our Board.

Your Board of Directors recommends a vote “FOR”FOR each of the nominees for Class A Director.

3

PROPOSAL 2: RATIFICATION OF BROWN, EDWARDS & COMPANY, L.L.P. AS THE

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Upon recommendation and selection by the Audit Committee, the Board of Directors acceptedapproved Brown, Edwards & Company, L.L.P. (“Brown Edwards”) as the independent registered public accounting firm to audit the consolidated financial statements of the Company for the year ending September 30, 2016.2018. Brown Edwards has served as our independent registered public accounting firm since 2006. The Audit Committee has reappointed Brown Edwards as the independent registered public accounting firm to audit our consolidated financial statements as of and for the fiscal year ending September 30, 20162019 and to audit our internal control processes.controls over financial reporting. A representative of Brown Edwards is expected to attend the meeting.

The Company’s Audit Committee is solely responsible for selecting the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2016.2019. Although shareholder ratification of the appointment of Brown Edwards is not required by the Company's bylaws, the Board of Directors believes that it is desirable to do so. If the shareholders do not ratify the appointment of Brown Edwards, the Audit Committee will consider whether to engage another independent registered public accounting firm. If the appointment of Brown Edwards is ratified by shareholders, the Audit Committee may change the appointment at any time if it determines a change would be in the best interest of the Company and its shareholders.

Your Board of Directors recommends a vote “FOR”FOR the ratification of Brown, Edwards & Company, L.L.P.

PROPOSAL 3: NON-BINDING SHAREHOLDER ADVISORY VOTE ON EXECUTIVE COMPENSATION

At the 20112017 Annual Meeting, our shareholders voted to have ancontinue the annual shareholder review of executive compensation. We believe that our executive compensation program is competitive within the industry and strongly aligned with the long-term interests of our shareholders. This program has been designed to promote a performance-based culture and ensure a philosophy of long-term value creation by aligning the interests of the executive officers with those of our shareholders by linking a meaningful portion of their compensation to the Company’s performance. The program is also designed to meet short-term objectives and to attract and retain highly-talented executive officers who are critical to the successful execution of the Company’s strategic business plan.

We also believe that both the Company and shareholders benefit from constructive and consistent dialogue. The proposal set forth above is intended to give you the opportunity to endorse or not endorse the compensation we paid to our named executive officers for fiscal 2015.2018 and the proposed compensation for fiscal 2019.

The Compensation Committee has overseen the development of the executive compensation program, as described more fully in the Compensation, Discussion and Analysis section of this Proxy Statement.

Please note that your vote is advisory and will not be binding upon the Company or the Board of Directors. However, the Board of Directors and Compensation Committee value the opinions that our shareholders express in their votes and in any additional dialogue. Consequently, the Compensation Committee intends to take into account the outcome of the vote when considering future executive compensation decisions for our executive officers.

Your Board of Directors recommends a vote “FOR”FOR approval, on an advisory basis, of executive compensation of the named executive officers compensation as disclosed in this proxy statement.

4

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Company’s Board of Directors (the "Board") consists of nine directors and is divided equally into three classes, with staggered three-year terms. The Board has separate persons serving as its Chair and as the President and Chief Executive Officer ("CEO") of the Company, which, as discussed below under "The Board's Role in Risk Oversight" section, we believeCompany. The Board believes this is the most appropriate leadership structure at this time for the Company.time.

The Board met nineeight times during the 20152018 fiscal year. All Board members attended at least 75 percent of Board and committee meetings in fiscal year 2015.2018. Consistent with NASDAQ rules, a majority of the Company’s non-management directors met at least once each quarter without management present. All of the directors serving on the Board atattended the time attended the2018 Annual Meeting of shareholders in 2015.

shareholders. The present principal occupation and employment during the past five years, and the office held with the Company, if any, of each director:

Name and Age | Year In Which First Elected As Director | Business Experience | Year in Which Assumed Principal Occupation |

CLASS A DIRECTORS (Currently serving until 2016 Annual Meeting) | |||

Abney S. Boxley, III Age 57 | 1994 | See disclosure in Proposal No. 1 above. | 1988 |

S. Frank Smith Age 67 | 1990 | See disclosure in Proposal No. 1 above. | 2014 |

John B. Williamson, III Age 61 | 1998 | See disclosure in Proposal No. 1 above. | 2014 |

CLASS B DIRECTORS (Serving until the 2017 Annual Meeting) | |||

Nancy Howell Agee Age 63 | 2005 | President, CEO & Director, Carilion Clinic; President & COO Carilion Clinic 2010-2011; COO & Executive Vice President, Carilion Clinic 2007-2010; Director, Hometown Bank; and Director, Virginia Tech Carilion School of Medicine. As the CEO of the largest employer in the Company's service area and her active leadership and participation in the community, Mrs. Agee is a valuable Board member. | 2011 |

J. Allen Layman Age 63 | 1991 | Private Investor and Director, Bank of Fincastle. A former CEO, Mr. Layman's utility and regulatory experience makes him a valuable Board member. | 2003 |

Raymond D. Smoot, Jr. Age 68 | 2005 | Senior Fellow, Virginia Tech Foundation, Inc.; CEO & Secretary, Virginia Tech Foundation, Inc. 2003-2012; Chairman, Union Bankshares Corporation; and Director, Carilion Clinic. Dr. Smoot's professional experience and public company board experience make him a valuable Board member. | 2012 |

CLASS C DIRECTORS (Serving until the 2018 Annual Meeting) | |||

John S. D'Orazio Age 55 | 2014 | President, CEO & Director, RGC Resources, Inc. & Roanoke Gas Company. President and CEO, Roanoke Gas Company 2012-2014; Vice President & COO, Roanoke Gas Company 2003-2012. Mr. D'Orazio provides the Board with in-depth knowledge of the Company's operation, business strategy, risks and economic climate as well as extensive utility industry experience. | 2014 |

Maryellen F. Goodlatte Age 63 | 2001 | Attorney and Principal, law firm of Glenn, Feldmann, Darby & Goodlatte. Mrs. Goodlatte's experiences as an attorney in the Company's service area, in addition to her leadership as chair of the Governance and Nominating Committee, make her a valuable member of the Board. | 1983 |

George W. Logan Age 70 | 2002 | Principal, Pine Street Partners, LLC; Faculty, University of Virginia Darden Graduate School of Business. Mr. Logan's board governance and financial expertise as well as his professional business experiences make him a valuable Board member. | 1993 |

Name and Age | Year In Which First Elected As Director | Business Experience | Year in Which Assumed Principal Occupation |

CLASS A DIRECTORS (Currently serving until the 2019 Annual Meeting) | |||

Abney S. Boxley, III Age 60 | 1994 | See disclosure in Proposal No. 1 above. | 2018 |

S. Frank Smith Age 70 | 1990 | See disclosure in Proposal No. 1 above. | 2018 |

John B. Williamson, III Age 64 | 1998 | See disclosure in Proposal No. 1 above. | 2014 |

CLASS B DIRECTORS (Serving until the 2020 Annual Meeting) | |||

Nancy Howell Agee Age 66 | 2005 | President, CEO & Director, Carilion Clinic; President & COO Carilion Clinic 2010-2011; COO & Executive Vice President, Carilion Clinic 2007-2010; Director, Healthcare Realty Trust Inc.; Director, Hometown Bank; Director, Virginia Tech Carilion School of Medicine; Chair, American Hospital Association. As the CEO of the largest employer in the Company's service area and her active leadership and participation in the community, Mrs. Agee is a valuable Board member. | 2011 |

J. Allen Layman Age 66 | 1991 | Private Investor. A former CEO, Mr. Layman's utility and regulatory experience makes him a valuable Board member. | 2003 |

Raymond D. Smoot, Jr. Age 71 | 2005 | Chairman, Union Bankshares Corporation; Senior Fellow, Virginia Tech Foundation, Inc. 2012-2017; CEO & Secretary, Virginia Tech Foundation, Inc. 2003-2012; Director, Carilion Clinic. Dr. Smoot's professional experience and public company board experience make him a valuable Board member. | 2017 |

CLASS C DIRECTORS (Currently serving until 2021 Annual Meeting) | |||

T. Joe Crawford Age 63 | 2018 | Vice President & General Manager, Steel Dynamics Roanoke Bar Division; President & Chief Operating Officer, Roanoke Electric Steel Corporation 2004-2006. Mr. Crawford's professional and community board experience make him a valuable Board member. | 2006 |

John S. D'Orazio Age 58 | 2014 | President, CEO & Director, RGC Resources, Inc. & Roanoke Gas Company. President & CEO, Roanoke Gas Company 2012-2014. Mr. D'Orazio provides the Board with in-depth knowledge of the Company's operations, business strategy, risks and economic climate as well as extensive utility industry experience. | 2014 |

Maryellen F. Goodlatte Age 66 | 2001 | Attorney & Principal, law firm of Glen Feldmann Darby & Goodlatte. Mrs. Goodlatte's experience as an attorney in the Company's service area, in addition to her leadership as chair of the Governance and Nominating Committee, make her a valuable member of the Board. | 1983 |

5

The Board has standing Compensation, Audit and Governance and Nominating committees. The Board has affirmatively determined that each of the Company’s current directors are considered independent directors in respect to each committee on which he or she serves, as determined under the Company’s independence standards adopted in accordance with the applicable rules of the SEC and the NASDAQ Stock Market, Inc.NASDAQ. In addition, the Board of Directors has determined that George W. LoganAbney S. Boxley III and Raymond D. Smoot, Jr. are audit committee financial experts under applicable SEC rules. The following table summarizes each committee.

| Committee | Members | Responsibilities | Independence |

| Compensation | S. Frank Smith, Chair | Assists the Board in fulfilling its oversight responsibilities relating to the compensation of the Company's directors and executive officers. | Each Member is Independent |

| Nancy Howell Agee | |||

| Abney S. Boxley, III | |||

| J. Allen Layman | |||

| Audit | Raymond D. Smoot, Jr., Chair | Reviews and assesses the Company’s processes to manage financial reporting risk and to manage investment, tax, and other financial risks. It also reviews the Company’s policies for risk assessment and steps management has taken to control significant risks, except those delegated by the Board to other committees. | Each Member is Independent |

| Abney S. Boxley, III | |||

| Governance | Maryellen F. Goodlatte, Chair | Responsible for the oversight of a broad range of issues surrounding the composition and operation of the Board, including identifying individuals qualified to become Board members, recommending nominees for Board election, and recommending to the Board governance principles. It also provides assistance to the Board in the areas of committee member selection and rotation practices, evaluation of the overall effectiveness of the Board and consideration of developments in corporate governance practices. | Each Member is Independent |

| and Nominating | Nancy Howell Agee | ||

The Board's Role in Risk Oversight

The Board and management have distinct roles in the identification, assessment and management of risks that could affect the Company. The Board exercises its responsibility for risk directly and through its three standing committees. In each Board or committee meeting,meetings, management provides periodic reports to provide guidance on risk assessment and mitigation. Each committee charged with risk oversight reports up to the Board on those matters.

Management provides regular updates to both the Audit Committee and the Board regarding cybersecurity and other related information technology matters. These updates include, but are not limited to, reviews of technology infrastructure changes, incident response plans, network and system testing, employee training programs and pertinent insurance programs.

The Board believes that its current leadership structure facilitates its oversight of risk by combining independent leadership, through independent board committees and majority independent board composition, with an experienced Chairman and a CEO who have intimate knowledge of the business, history, and the complex challenges the Company faces. The Chairman and CEO both have in-depth understanding of these matters, and the CEO has direct involvement in the day-to-day management of the Company, uniquely positioning him to promptly identify and raise key business risks to the Board.

Director Nominations

The Governance and Nominating Committee establishes the process by which candidates are selected for possible inclusion in the recommended slate of director nominees. The Governance and Nominating Committee has a charter, which is available on the Company's website at www.rgcresources.com. The Governance and Nominating Committee will take into account the Company’s current needs and the qualities needed for Board service, including experience and achievement in business, finance, technology or other areas relevant to the Company’s activities; reputation, ethical character and maturity of judgment; diversity of viewpoints, backgrounds and experiences; absence of conflicts of interest that might impede the proper performance of director responsibilities; independence under SEC and NASDAQ rules; service on other boards of directors; sufficient time to devote to Board matters; and the ability to work effectively with other Board members. In the case of incumbent directors whose terms of office are set to expire, the Governance and Nominating Committee will review such directors’ overall service to the Company during their term,

including the number of meetings attended, level of participation and quality of performance. For those potential

6

new director candidates who appear upon first consideration to meet the Board’s selection criteria, the Governance and Nominating Committee will conduct appropriate inquiries into their background and qualifications and, depending on the result of such inquiries, arrange for in-person meetings with the potential candidates.

The Governance and Nominating Committee may use multiple sources for identifying director candidates, including its own contacts and referrals from other directors, members of management, the Company’s advisers and executive search firms. The Committee will consider director candidates recommended by shareholders and will evaluate such director candidates in the same manner in which it evaluates candidates recommended by other sources. Any director candidates to be recommended by shareholders should be described in writing to Paul Nester,the Corporate Secretary, RGC Resources, Inc., P.O. Box 13007, Roanoke, VA 24030.Secretary. This recommendation must be sent no later than 120 days prior to the anniversary of the expected mailing date of this proxy statement,, in order to be considered for inclusion in the proxy statement for the 20172020 annual meeting of shareholders.

Transactions with Related Persons

The Board follows certain policies and procedures for the approval of transactions with related persons that are required to be reported under applicable SEC rules. The policy generally requires Audit Committee approval or ratification of transactions that involve more than $120,000 in which the Company is a participant and in which a Company director, nominee for director, executive officer, greater than 5% shareholder, or an immediate family member of any of the foregoing persons has a direct or indirect material interest, with variousinterest. Various other qualifications and exclusions for reportable related party transactions are set forth in applicable SEC rules, such as a transaction where the tariff gas service is at a rate approved by the Virginia State Corporation Commission or certain banking transactions. In reviewing a reportable related party transaction, the Audit Committee will, after reviewing all material information regarding the transaction, take into account, among other factors it deems appropriate, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related person’s interest in the transaction.

The Company has no transactions withother related personsparty transactions to report for fiscal 2015.2017 or 2018.

Compensation of Directors

| Annual Director Retainer | $ | 17,000 | $ | 44,000 | ||

| Additional Annual Retainer - Board Chair | 12,000 | 15,000 | ||||

| Additional Annual Retainer - Audit Committee Chair | 8,000 | 10,000 | ||||

| Additional Annual Retainer - Other Committee Chair | 3,000 | 7,000 | ||||

| Attendance - each Board of Directors Meeting | 1,500 | |||||

| Attendance - each Committee Meeting | 1,500 | |||||

| Attendance - Board or Committee Meeting by telephone | 800 | |||||

| Committee meeting held on the same day as Board meeting | 800 | |||||

| Additional Annual Retainer - Audit Committee | 8,000 | |||||

| Additional Annual Retainer - Other Committee | 2,000 | |||||

Restricted Stock Plan for Outside Directors. Under the Company's Amended and Restated Restricted Stock Plan for Outside Directors (the "Restricted"Director Restricted Plan"), originally adopted effective January 27, 1997, as amended on March 28, 2016 and amended and restated effective JulyOctober 1, 1999,2016, a minimum of 40% of the annual retainer fee paid to each non-employee director of the Company on a monthly basis is paid in shares of Company common stock of the Company restricted under the terms of the Director Restricted Plan ("Director Restricted Stock"). If the director owns more than 10,000 shares of Resources stock, the minimum requirement is waived. The number of shares of Director Restricted Stock paid each month is calculated each month based on the closing sales price on the first business day of the month closing price of Resources’ common shares on the NASDAQ Global Market.NASDAQ. A participant can, subject to approval of the Compensation Committee, elect to receive up to 100% of the retainer fee for the fiscal year in Director Restricted Stock. Such election cannot be revoked or amended during the fiscal year.

7

The shares of Director Restricted Stock will vest only in the case of a participant’sdirector’s death, disability, retirement (including not standing for reelection to the Board), or in the event of a change in control of Resources. There is no option to take cash in lieu of stock upon vesting of shares under this Plan. The Director Restricted Stock may not be sold, transferred, assigned or pledged by the participant until the shares have vested under the terms of this Plan. The shares of Director Restricted Stock will be forfeited to Resources by a participant’sdirector’s voluntary resignation during his or her term on the Board or removal for cause as a director.cause.

Fiscal Year 20152018 Director Fees and Restricted Stock Holdings

| Name | Fees paid in cash | Fees paid in Restricted Stock2 | Total | Fees paid in cash | Fees paid in Restricted Stock1 | Total Fees | Shares of Restricted Stock as of 9/30/18 | |||||||

| Nancy Howell Agee | $ 15,100 | $ 16,667 | $ 31,767 | $ 6,800 | $ 39,250 | $ 46,050 | 21,146 | |||||||

| Abney S. Boxley, III | 28,633 | 8,333 | 36,966 | 6,800 | 43,750 | 50,550 | 20,608 | |||||||

| T. Joe Crawford | 23,400 | 13,333 | 36,733 | 507 | ||||||||||

| Maryellen F. Goodlatte | 23,967 | 9,667 | 33,634 | 27,225 | 22,125 | 49,350 | 16,995 | |||||||

| J. Allen Layman | 25,800 | 6,667 | 32,467 | 46,050 | — | 46,050 | 37,836 | |||||||

| George W. Logan | 18,200 | 16,667 | 34,867 | |||||||||||

| S. Frank Smith | 29,967 | 9,667 | 39,634 | 31,925 | 25,125 | 57,050 | 23,246 | |||||||

| Raymond D. Smoot, Jr. | 33,200 | 9,600 | 42,800 | 57,100 | — | 57,100 | 20,957 | |||||||

John B. Williamson, III1 | 22,900 | 7,733 | 30,633 | |||||||||||

| John B. Williamson, III | 38,000 | 20,800 | 58,800 | 3,097 | ||||||||||

Note 1: Mr. Williamson began receiving Director fees February 1, 2015.

non-employee directors must be paid in the form of

Director Restricted Stock.Stock, unless a participant owns at least 10,000 shares of Company stock. This

in the form of Director Restricted

Stock pursuant to the election of the director.

The following table showslists directors who elected to receive a higher

percentage of their fees as Director Restricted Stock:Stock in fiscal 2018:

| Name | Percent if Greater than 40% |

| Nancy Howell Agee | 100% |

| Abney S. Boxley, III | |

| Maryellen F. Goodlatte | 50% |

| S. Frank Smith | 50% |

Section 1616(a) Beneficial Ownership Reporting Compliance

Based on the Company's review of the copies of forms related to Section 16(a) of the Securities Exchange Act of 1934 regarding beneficial ownership reporting and representations from certain reporting persons, no other reports are required and no forms wereone Form 3, covering Mr. Crawford, was filed lated.late in fiscal 2018.

EXECUTIVE OFFICERS

| Name and Age | Period Position Held | Position and Experience |

| John S. D'Orazio, | February 2014 to present | President & CEO - Resources, Roanoke Gas |

| October 2012 to February 2014 | President & CEO - Roanoke Gas | |

| Paul W. Nester, | February 2015 to present | Vice President, Treasurer, Secretary & CFO |

| May 2012 to January 2015 | Vice President, Treasurer & CFO | |

| Carl J. Shockley, Jr., | October 2012 to present | Vice President, Operations - Roanoke Gas |

| May 2012 to September 2012 | Director, Operations - Roanoke Gas | |

| Robert L. Wells, II, | February 2005 to present | Vice President, Information Technology |

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth, as of November 25, 2015,23, 2018, certain information regarding the beneficial ownership of the common shares of the Company by all directors and nominees, named executive officers, any holders of more than 5% of common shares and certain beneficial owners as a group. Unless otherwise noted in the footnotes to the table, the named persons have sole voting and investment power with respect to all outstanding common shares shown as beneficially owned by them. Unless otherwise indicated, theThe business address of each beneficial owner listed inof the table belowCompany's directors and executive officers is c/o RGC Resources, Inc. P.O. Box 13007 Roanoke, Virginia 24030.the Company's address.

Name of Beneficial Owner | Common Shares Beneficially Owned as of 11/25/151 | Percent of Class | Common Shares Beneficially Owned as of 11/23/181 | Percent of Class |

Nancy Howell Agee2 | 12,737 | <1% | 31,669 | <1% |

| Abney S. Boxley, III | 20,812 | <1% | ||

Abney S. Boxley, III5 | 37,212 | <1% | ||

| T. Joe Crawford | 5,132 | <1% | ||

John S. D’Orazio3 | 31,024 | <1% | 74,116 | <1% |

| Maryellen F. Goodlatte | 14,615 | <1% | 26,088 | <1% |

| J. Allen Layman | 39,914 | <1% | 63,640 | <1% |

| George W. Logan | 56,509 | 1.2% | ||

Paul W. Nester3 | 15,239 | <1% | 42,214 | <1% |

Dale L. Parris3 | 8,000 | <1% | ||

Carl J. Shockley, Jr.3 | 10,761 | <1% | 23,568 | <1% |

| S. Frank Smith | 53,027 | 1.1% | 87,926 | 1.1% |

Raymond D. Smoot, Jr.4 | 21,269 | <1% | 37,304 | <1% |

Robert L. Wells, II3 | 11,735 | <1% | 26,799 | <1% |

| John B. Williamson, III | 86,332 | 1.8% | 131,871 | 1.6% |

| Anita G. Zucker | 297,692 | 6.3% | ||

| c/o The Inter Tech Group, 4838 Jenkins Ave. | ||||

| North Charleston, SC 29405 | ||||

| All current directors and executive officers (as a Group - 12 Persons) | 373,974 | 7.9% | ||

All current directors and executive officers aaa(as a Group - 12 Persons) | 587,539 | 7.3% | ||

Note 1: Includes Director Restricted Stock Plan shares issued to outside directors and Officer Restricted Stock shares issued to the

named officers still subject to vesting.

Note 2: Includes 1,84526,605 shares owned by spouse.in trust and 5,064 shares owned in spousal trust.

Note 3: Includes stock options shown in the Outstanding Equity Awards at Fiscal Year End section on page 14. All are

exercisable and included as shares beneficially owned.

Note 4: Includes 250375 shares owned by spouse.

Note 5: Includes 1,125 shares owned by children in minor trust.

COMPENSATION DISCUSSION AND ANALYSIS

We are committed to creating shareholder value. In 2018, we achieved our fourth consecutive year of record earnings. Net Income was $7.3 million, or $0.95 per share, compared to $6.2 million, or $0.86 per share, in 2017. Also in 2018, the Board approved a 6.9% annual cash dividend increase to $0.62 per share. The Board has increased the cash dividend every year since 2004.

Our compensation philosophy is designed to incentivize management to create shareholder value, by attracting and retaining talent, rewarding performance and instilling an ownership culture. Our Restricted Stock Plan is intended to advance those goals, by further aligning senior management with our shareholders. As described below, we pay a portion of bonuses in the form of restricted stock, based on earnings targets. This section provideswill provide an overview of our executive compensation philosophy and why we believe the programit is appropriate for the Company and its shareholders.

We also discuss the Compensation Committee’s methodology for determining appropriate and competitive levels of compensation for the named executive officers. Details of compensation paid to the named executive officers can be found in the tables that follow.

Compensation Philosophy and Objectives

Who are the named executive officers for fiscal year 2015?2018?

The named executive officers for fiscal year 2015who currently serve as executive officers of the Company are John S. D’Orazio, Paul W. Nester, Carl J. Shockley, Jr., and Robert L. Wells, II, as well as retired officer, Dale L. Parris.II.

9

What person or group is responsible for determining the compensation levels of named executive officers?

The Compensation Committee has a charter, pursuant to which it reviews and recommends to the Board the compensation, including base salary and annual incentive compensation, of the Company’s CEO and the other named executive officers.

The CEO is actively involved in the executive compensation process. The CEO reviews the performance of each of the named executive officers, other than his own, and, within the defined program parameters, recommends to the Compensation Committee base salary increases and incentive awards for such individuals. He provides the Compensation Committee with financial performance goals for the Company that are used to link pay with performance. The CEO also provides his review to the Compensation Committee with respect to the executive compensation program’s ability to attract, retain and motivate the level of executive talent necessary to achieve the Company’s business goals. The CEO attends the meetings of the Compensation Committee but does not participate in the Committee executive sessions.

The Compensation Committee did not utilize an outside consultant in fiscal year 2015.2018.

What are the Company’s executive compensation principles and objectives?

The Company’s overall executive compensation philosophy is that pay should be competitive with the relevant market for executive talent, be performance-based,performance based, vary with the attainment of specific objectives and be aligned with the interests of the Company’s shareholders. The core principles of the Company’s executive compensation program include the following:

Pay competitively. The Compensation Committee believes in positioning executive compensation at levels necessary to attract and retain exceptional leadership talent. An individual’s performance and importance to the Company can result in total compensation being higher or lower than the target market position.

Pay-for-performance. The Compensation Committee structures executive compensation programs to balance annual and long-term corporate objectives, including specific measures which focus on operational and financial performance through incentive bonuses and the goal of fostering shareholder value creation through grants ofrestricted stock options and payment of some bonuses in stock.grants.

Create an ownership culture. The Compensation Committee believes that using compensation to instill an ownership culture effectively aligns the interests of executive officers and the shareholders. HalfA significant portion of allour incentive compensation awarded to executive officers is required to be taken in the Company’sform of restricted common shares until a level of common share ownership valued at 50% of annual base salary is obtained.stock. The restrictions are intended to promote stock ownership. In addition, the Committee oversees a modest stock option plan intended to encourage stock ownership.

The CEO and the Compensation Committee periodically review the executive compensation philosophy. No recent changes have recently been made to the compensation philosophy; however, programmatic changes have been implemented at various times to enhance the effectiveness of the various compensation elements.

How do we determine executive pay?

The Compensation Committee benchmarks base salary, annual incentive bonus, other forms of incentive compensation and the Company's financial performance to a comparison group consisting of publicly traded gas utilities and local companies. The Compensation Committee believes this is the best way to determine whether such compensation is competitive. The comparison group is selected based on six criteria:

| 1. | Companies that an outsider, with no knowledge of the Company’s internal deliberations on the topic, would agree offer reasonable comparisons for pay and performance purposes; |

| 2. | Companies that may overlap in the labor market for talent; |

| 3. | Companies with revenue and market capitalizations reasonable for comparison; |

| 4. | Companies whose business models, characteristics, growth potential, and human capital are similar but not necessarily identical to those of the Company; |

| 5. | Public companies based in the United States where compensation and |

| 6. | Companies large enough to have similar executive positions to ensure statistical significance. |

10

Based on these criteria, the comparison group consists of:

Chesapeake Utilities Corporation Optical Cable CorporationHometown Bankshares, Inc.

Corning Natural Gas Holding Corporation Luna Innovations Incorporated

NW Natural, Inc. Unitil Corporation

In addition to the comparison group, the Compensation Committee utilizes market compensation data from Salary.com and Mercer,CompAnalyst, a benefits and compensation consulting firm, for each of its executive positions. This data provides benchmark information for both base pay and total compensation for energy and utility companies in the $50 million to $500 million$3.6 billion size range. While the Compensation Committee has not established a specific target for each executive officer position, the Committee uses the comparison group and salary benchmark data to help ensure compensation is reasonably competitive in the industry and local job market. In no case does executive officer base pay exceed the 50th percentile of the benchmark data.

How do we consider the results of the most recent shareholder advisory vote on executive compensation?

Annually, we ask our shareholders for a non-binding advisory vote on our overall executive compensation. While this vote is not binding, theThe Board does reviewreviews and considerconsiders the voting results. In 2015, 95%2018, 96% of votes cast were in favor of the proposal. Since a substantial majority of our shareholders voted in favor of our executive compensation philosophy and program, wethe Board determined that we did not need to consider changing our overall approach to executive compensation.compensation was not necessary at this time.

Compensation Elements

Base Salary. Base salary is fixed compensation and is a standard element of compensation necessary to attract and retain talent. Base salaries are the only non-variable element of the Company’s total compensation program. Base salaries are set to reflect each named executive officer’s responsibilities, the impact of each named executive officer’s position and the contribution each named executive officer delivers to the Company. Salaries are determined after analyzing competitive levels in the market, using the Company’s comparison group and the Salary.com and MercerCompAnalyst compensation data for executives with comparable responsibilities and job scope. The Compensation Committee also considers internal equities among employees within the Company. Salary increases, if any, are based on individual performance, Company performance and market conditions. To gauge market conditions, the Compensation Committee evaluated the comparison group and market data and established recommended salary levels based on the named executive’s experience, tenure, performance and potential. Based in part on the executive compensation benchmarking and the target levels for base salary set forth above, the Board, acting on the recommendation of Compensation Committee, set the named executive officers’ base salaries for 2015.2018.

RGC Resources, Inc. Restricted Stock Plan. The Company has a Restricted Stock Plan which is intended to provide equity incentives to our key employees. Each restricted stock award will be evidenced by an agreement with the recipient. The agreement shall set forth the "Vesting Period" and "Restriction Period" for the award and any other conditions or restrictions that the Compensation Committee deems advisable, including requirements established pursuant to the Securities Act, the Exchange Act, the Internal Revenue Code and any securities trading system or stock exchange upon which such restricted shares are listed.

The "Vesting Period" for an award represents substantial risk of forfeiture until certain dates, at which time such shares or a portion of such shares shall begin to "vest" over time and no longer be subject to a substantial risk of forfeiture. The default Vesting Period for an award shall be three years with one-third of the shares vesting on the first, second and third anniversaries of

11

the effective date of the award, respectively, unless the Compensation Committee establishes otherwise. If a recipient resigns or is otherwise terminated from employment with the Company prior to the end of the Vesting Period, he or she will forfeit all interest to his or her unvested shares of restricted stock granted in an award. Unless otherwise established in an award agreement by the Compensation Committee, in the event of a recipient's death, disability or normal retirement (as considered under our defined benefit pension plan), all of the awarded shares shall vest and no longer be subject to a substantial risk of forfeiture. Likewise, all awarded shares shall vest in the event of a change in control, as defined in the recipient's agreement with the Company that relates to recipient's compensation and benefits upon the occurrence of a change in ownership of the Company or similar event (i.e., our Change-in-Control Agreement).

The "Restricted Period" for an award represents a period during which the recipient may not transfer, sell, pledge, assign, or otherwise alienate or hypothecate shares of restricted stock, and all cash dividends on such shares must be re-invested in our common stock. Unless the Compensation Committee otherwise determines, the Restricted Period shall apply so long as shares of restricted stock are unvested and thereafter apply to 75% of such vested shares unless the recipient satisfies the following minimum ownership levels of our common stock:

President, CEO 300% of annual base salary

CFO, COO 200% of annual base salary

Vice President 150% of annual base salary

The Compensation Committee will use its discretion to determine when and how such minimum levels are measured. Once a recipient satisfies the minimum level of ownership or once a recipient is no longer employed by the Company, the Restricted Period will no longer be applicable to vested shares. A change in control will not affect the Restricted Period.

Key Employee Stock Option Plan of RGC Resources, Inc. The Company has a Key Employee Stock Option Plan, which is intended to provide the Company’s executive officers and other key employees with long-term incentives and future rewards tied to the price of Resources’ common shares over time.

This Plan requires each option’s exercise price per share to equal the fair value of the Company’s common shares as of the date of the grant. Under the terms of this Plan, the options become exercisable six months from the grant date and expire ten years subsequent to the grant date. There were 17,00025,500 shares granted in 2015December 2016 to the named officers based on each officer's level of responsibility and the Compensation Committee’s assessmentCommittee's ongoing decision to link a portion of the appropriate allocationofficer compensation directly to long-term corporate performance. The Compensation Committee did not use specific performance metrics in making these grants. The Key Employee Stock Option Plan continues in force in respect of previously granted options among the officer group.with 36,000 options available for issue. We do not anticipate stock options being a significant part of our future compensation structure.

RGC Resources, Inc. Stock Bonus Plan. The Company has not made awards under the Stock Bonus Plan contains a policy thatin recent years to the named executive officers. The Stock Bonus Plan was effectively replaced by the RGC Resources, Inc. Restricted Stock Plan in fiscal 2018.

Discussion and Analysis of Summary Compensation

The changes in salary for our named executive officers are encouragedprimarily reflect their increasing responsibilities and significant contributions to own a position in the Company’s common shares equal to at least 50%success of the valueCompany in fiscal 2018. The Committee also considered competitive market forces and the comparison group in setting the 2019 salary levels. The decrease in pension values are directly attributable to the impact of their annual salary. To promote this policy,higher discount rates on the Plan provides that all officers with stock ownership positions below 50% of the value of their annual salaries must, unless approved by the Committee, use no less than 50% of the amount of any performance incentive bonus to acquire common shares from the Company under the plan.actuarially calculated benefit.

12

Summary Compensation Table

Name | Year | Salary | Options Award1 | Bonus | Change in Pension Value2 | All Other Compensation | Total | Year | Salary | Bonus1 | Stock Awards2,3 | Option Awards4 | Non-equity Incentive Plan Compensation | Change in Pension Value5 | All Other Compensation | Total | ||||||||||||||||

| John S. D'Orazio | 2015 | $ 325,353 | $ 24,600 | $ 76,900 | $ 106,405 | $ 36,418 | $ 569,676 | 2018 | $ 418,070 | $ | — | $ 151,406 | $ | — | $ 161,208 | $ 29,429 | $ 40,901 | $ 801,014 | ||||||||||||||

| President & CEO | 2014 | 272,557 | 22,150 | 38,000 | 140,043 | 41,087 | 513,837 | 2017 | 391,084 | 135,000 | 156,000 | 28,210 | — | 51,389 | 53,257 | 814,940 | ||||||||||||||||

| 2013 | 223,248 | 28,280 | 26,500 | 10,662 | 35,215 | 323,905 | 2016 | 363,300 | 159,400 | — | 22,220 | — | 263,681 | 34,323 | 842,924 | |||||||||||||||||

| Paul W. Nester | 2015 | 184,867 | 19,680 | 30,000 | 17,370 | 28,862 | 280,779 | 2018 | 253,417 | — | 62,938 | — | 86,953 | 24,792 | 54,337 | 482,437 | ||||||||||||||||

| VP, Treasurer, | 2014 | 166,229 | 17,720 | 23,000 | 19,390 | 26,403 | 252,742 | 2017 | 221,511 | 64,688 | 58,500 | 21,700 | — | 28,799 | 48,563 | 443,761 | ||||||||||||||||

| Secretary & CFO | 2013 | 146,350 | 20,200 | 6,500 | 9,984 | 18,843 | 201,877 | 2016 | 207,353 | 66,000 | — | 20,200 | — | 41,494 | 33,410 | 368,457 | ||||||||||||||||

| Robert L. Wells, II | 2015 | 161,957 | 12,300 | 27,000 | 77,973 | 33,766 | 312,996 | 2018 | 188,931 | — | 32,597 | — | 50,039 | 60,903 | 47,023 | 379,493 | ||||||||||||||||

| VP, | 2014 | 149,320 | 11,075 | 22,000 | 88,103 | 31,337 | 301,835 | |||||||||||||||||||||||||

| Information Technology | 2013 | 138,548 | 12,120 | 20,000 | (15,149 | ) | 28,154 | 183,673 | ||||||||||||||||||||||||

| VP, Information | 2017 | 182,240 | 40,940 | 34,710 | 10,850 | — | 64,063 | 39,990 | 372,793 | |||||||||||||||||||||||

| Technology | 2016 | 171,010 | 49,000 | — | 10,100 | — | 189,255 | 37,698 | 457,063 | |||||||||||||||||||||||

Carl J. Shockley, Jr.3 | 2015 | 148,743 | 14,760 | 27,800 | 74,310 | 29,887 | 295,500 | |||||||||||||||||||||||||

| Carl J. Shockley, Jr. | 2018 | 201,520 | — | 34,200 | — | 52,020 | 84,301 | 47,689 | 419,730 | |||||||||||||||||||||||

| VP - Operations, | 2014 | — | — | — | — | — | — | 2017 | 189,267 | 42,036 | 36,270 | 13,020 | — | 127,783 | 104,693 | 513,069 | ||||||||||||||||

| Roanoke Gas Co. | 2013 | — | — | — | — | — | — | 2016 | 172,566 | 48,000 | — | 12,120 | — | 181,826 | 32,312 | 446,824 | ||||||||||||||||

| Dale L. Parris | 2015 | 109,751 | 12,300 | 25,200 | 67,570 | 65,736 | 280,557 | |||||||||||||||||||||||||

| Vice President, | 2014 | 155,816 | 11,075 | 19,000 | 99,895 | 19,942 | 305,728 | |||||||||||||||||||||||||

| Retired | 2013 | 148,344 | 12,120 | 19,400 | 10,627 | 23,829 | 214,320 | |||||||||||||||||||||||||

Note 1: Bonus amounts were earned in the respective year and paid in the following year.

Note 2: In October 2018, in respect of fiscal 2018 performance, the Company approved a total of 10,227 shares of restricted stock

to be issued to our named executive officers effective January 2, 2019. Mr. D'Orazio received 5,508 shares which is equal

to $151,406 based on the closing price of $27.49 as reported on NASDAQ on October 24, 2018. Mr. Nester received

2,289 shares, which is equal to $62,938 based on such closing price. Mr. Wells received 1,186 shares, which is equal to

$32,597 based on such closing price. Mr. Shockley received 1,244 shares, which is equal to $34,200 based on such

closing price.

Note 3: In October 2017, in respect of fiscal 2017 performance, the Company approved a total of 10,101 shares of restricted stock

to be issued to our named executive officers effective January 2, 2018. Mr. D'Orazio received 5,520 shares which is equal

to $156,000 based on the closing price of $28.26 as reported on NASDAQ on October 30, 2017. Mr. Nester received

2,070 shares, which is equal to $58,500 based on such closing price. Mr. Wells received 1,228 shares, which is equal to

$34,710 based on such closing price. Mr. Shockley received 1,283 shares, which is equal to $36,270 based on such

closing price.

Note 4: The 2015 Options Award2017 Option Awards values are based on 5,0009,750 shares for Mr. D’Orazio, 4,000D'Orazio, 7,500 shares for Mr. Nester, 3,0004,500 shares for Mr. Shockley and 2,5003,750 shares for Mr. Wells and Ms. Parris.Wells. The 2014 Options Award2016 Option Awards values are based on 5,0008,250 shares for Mr. D’Orazio, 4,0007,500 shares for Mr. Nester, and 2,5004,500 shares for Mr. WellsShockley and Ms. Parris. The 2013 Options Award values are based on 7,0003,750 shares for Mr. D’Orazio, 5,000 shares for Mr. Nester, and 3,000 shares for Mr. Wells and Ms. Parris. Wells.

Note 2:5: The Change in Pension Value is an actuarial calculation and was not realized as compensation.

| Estimated Possible Payouts under Performance Incentive Plan | Estimated Possible Payouts under Performance Incentive Plan | ||||||||||||||||||

| Name | Target | Maximum | Paid1 | Grant Date | Type | Metric | Threshold | Target | Maximum | Awarded1 | % of Target | ||||||||

| John S. D’Orazio | $ 74,000 | $ 174,000 | $ 76,900 | 10/29/2018 | Cash | Performance Achievements | $ | — | $ 148,750 | $ 185,938 | $ 161,208 | 108.4 | |||||||

| 10/29/2018 | Equity2 | Earnings | — | 127,500 | 191,250 | 151,406 | 118.7 | ||||||||||||

| Paul W. Nester | 32,500 | 55,000 | 30,000 | 10/29/2018 | Cash | Performance Achievements | — | 79,500 | 99,375 | 86,953 | 109.4 | ||||||||

| 10/29/2018 | Equity2 | Earnings | — | 53,000 | 79,500 | 62,938 | 118.8 | ||||||||||||

| Robert L. Wells, II | 25,500 | 46,000 | 27,000 | 10/29/2018 | Cash | Performance Achievements | — | 45,750 | 57,188 | 50,039 | 109.4 | ||||||||

| Carl J. Shockley | 28,500 | 49,000 | 27,800 | ||||||||||||||||

| Dale L. Parris | 25,500 | 46,000 | 25,200 | ||||||||||||||||

| 10/29/2018 | Equity2 | Earnings | — | 27,450 | 41,175 | 32,597 | 118.8 | ||||||||||||

| Carl J. Shockley, Jr. | 10/29/2018 | Cash | Performance Achievements | — | 48,000 | 60,000 | 52,020 | 108.4 | |||||||||||

| 10/29/2018 | Equity2 | Earnings | — | 28,800 | 43,200 | 34,200 | 118.8 | ||||||||||||